Banking is no longer about just storing or spending money, and I believe it’s been drifting away from that for quite some time now. It has evolved more into anticipating customers’ needs, while predicting their next step and engaging with them throughout their lives. But is that enough?

Millennials and Gen Z (zoomers) are the generations with distinct expectations from a bank than those before them. They want someone to guide them while making financial decisions, they want advice about budgeting, debts, savings, and most importantly, they want transparency about what’s good for them and what’s not. Unlike previous generations, when millennials and zoomers are unhappy with the services they’re receiving, they’re not afraid to move to what they’d believe is a better option.

So, what factors drive their decision-making when choosing a bank? Here’s my take on the most important trends that shapes these generations’ banking habits.

Convenience and perks take centre-stage

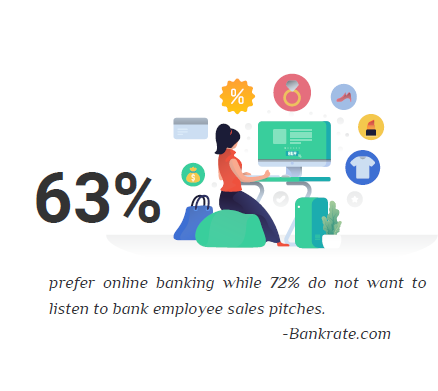

Millennials and zoomers are tech-savvy and prefer to do everything on their mobile phone or through online banking (we can’t expect anything less from a generation that grew up with smart phones and tablets as their main educational tools.) According to a new study by Bankrate.com, 63% of millennials use online banking, while 72% of millennials said they would rather go to the dentist than listen to bank employee sales pitches.

They expect quicker services; they want to get things done within seconds rather than minutes, which is why they’re always looking for instant digital processes, at a time that suits them, not the bank. With over a third of new Liv accounts being opened between 10 pm to 6 am, it’s hardly a surprise that customers no longer have the patience (or need) for branch open timings! Their smartphone must provide them with everything they need to manage and track their personal finances. More perks and rewards? Yapp, count them in on that but make sure it’s the right deal at the right time for the right person and on their smartphone! They’re ready to switch banks if they see that the grass is greener on the other side. So, it’s extra important for banks to continuously communicate with them in a language they can relate to while keeping them engaged.

Give advice, but please don’t judge them

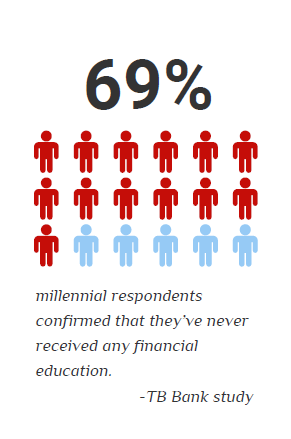

According to a recent study made by TB Bank, 69% of the millennial respondents confirmed that they’ve never received any financial education. Banks have a unique opportunity to simplify money matters for their customers, especially younger ones. It is essential for banks to help young adults establish good money management habits early on and encourage them to start saving early. As I mentioned before, these generations want transparent tips about finances, budgeting, debts, etc. Don’t buy into popular myths like millennials don’t save (or that they all love avocados!) Our Liv Goal Accounts data shows that an 18-year-old university student is as likely to start saving for a Goal as a 30 or a 40 year old customer! And yes, they do Save for a Rainy Day, besides everything else! They need to know how they can better finance the experiences they value the most; and with these kinds of financial advice, this generation will turn towards you as a bank even more.

Define your purpose and make sure it aligns with their values

At this point, most of us know that selling products and services blindly doesn’t go a long way with millennials and zoomers, more so because they are driven mainly by their value-system. According to Euclid’s recent survey, 52% of millennials feel it’s important that their values align with the brands they like. They don’t care if your product or service is the best in the world, what does it stand for? What is your business’ core purpose and how does that relate to them? It’s time for brands to communicate what they believe in and truly live those values in order to be successful. The more your brand is open and authentic, the more people will relate to your core values. There’s an old saying: “Reputation is everything.” Some may think of it as a dusty cliché, but if you think about it, it’s never been as relevant as now.

It’s time for banks to really be one step ahead in order to not fall behind. A good start would be by understanding what values matter the most for millennials and zoomers, and how to incorporate those into your own values while communicating it further to these young adults.